SEC’s Proposed Custody Rule Faces Backlash from JPMorgan, Crypto Firms, and Fellow Agency

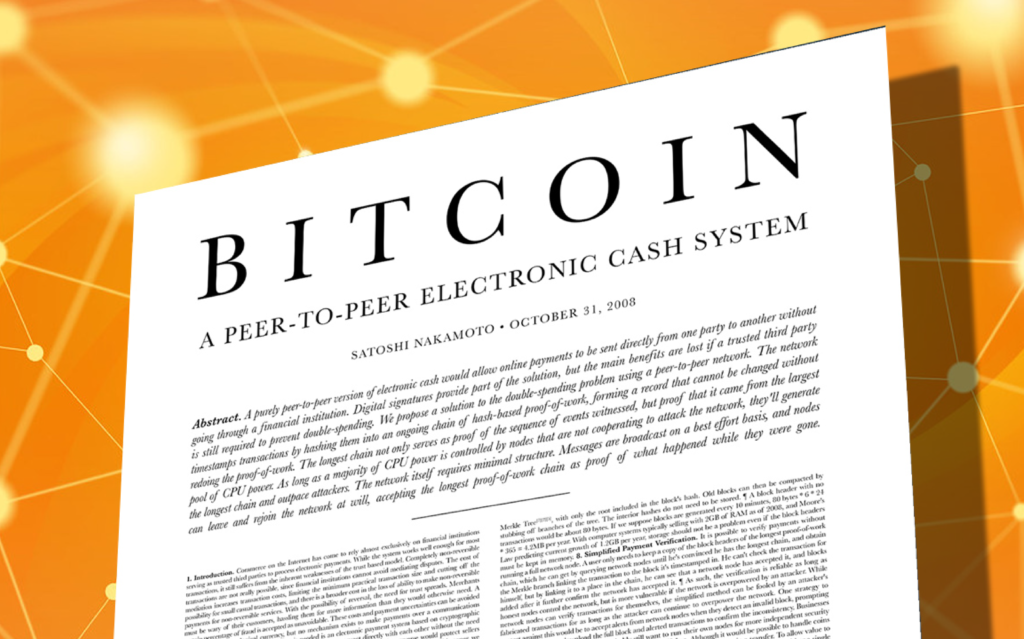

The U.S. Securities and Exchange Commission (SEC) has recently proposed a new rule that would require registered investment advisers to secure their clients’ assets, including cryptocurrency, with qualified custodians. However, the proposal has been met with strong criticism from a wide range of critics, including financial giant JPMorgan, the Small Business Administration (SBA), and the crypto industry. Expansion of Asset Protection The SEC’s proposal for expanded asset protection includes pretty much everything that investment firms are responsible for, and not just cryptocurrency. It aims to extend the requirement for registered investment advisers to keep customers’ assets with qualified custodians. However, critics argue that the cost of these sweeping changes could have significant impacts on smaller investment advisers, leading to their merger with others or exit from the business. Qualified Custodians Definition The proposed rule by the SEC specifies that any assets entrusted to investment advisers must be held with qualified custodians, which generally include a chartered bank or trust company, a broker-dealer registered with the SEC, or a futures commission merchant registered with the Commodity Futures Trading Commission (CFTC). However, crypto platforms that currently maintain custody of investors’ assets do not qualify as qualified custodians, according to SEC Chair Gary Gensler. Criticism from Wall Street and Crypto Sector JPMorgan has criticized the SEC’s proposal for taking an overly broad approach that could disrupt the operations of financial markets, which have been functioning well for many years. The Securities Industry and Financial Markets Association, the securities industry’s chief lobbying group, called it jurisdictional overreach resulting in indirect and inappropriate regulation. Investment firm a16z from the crypto sector believes that the proposed prohibition is illegal, infeasible, and dangerous. They suggest that the rule would be almost impossible to comply with because it largely failed to consider the logistics of how custody works for many crypto assets, the economics underpinning crypto asset markets, and even the basic statistics and other data that should inform a considered regulatory approach. Conclusion The SEC’s proposed rule for registered investment advisers to keep customers’ assets with qualified custodians has faced backlash from a wide range of critics, including financial giant JPMorgan, the Small Business Administration, and the crypto industry. Critics argue that the sweeping changes could lead to significant impacts on smaller investment advisers, pushing them to merge with others or exit the business. However, the proposal is yet to be finalized, and the SEC is still reviewing public comments.

CryptOliphant

Meet Ellie, an oliphant with a keen interest in cryptocurrency. Known for her enchanting instincts, Ellie has ventured from the mystical forests into the crypto wilderness. She’s become a self-taught crypto expert, offering a range of magical services, including Market Analysis, OliphantTrade Signals expressed through stomp patterns, and Enchanted-Consulting. A fan of enchantment-themed altcoins like MysticChain and EnchantedCoin, she loves conversing with forest creatures and tending to her enchanted garden when she’s not busy with crypto. Connect with Ellie by leaving a message inscribed on a magical scroll in a hollow tree trunk.