The Impact of Coinbase CEO Brian Armstrong’s Share Sales and the SEC Lawsuit

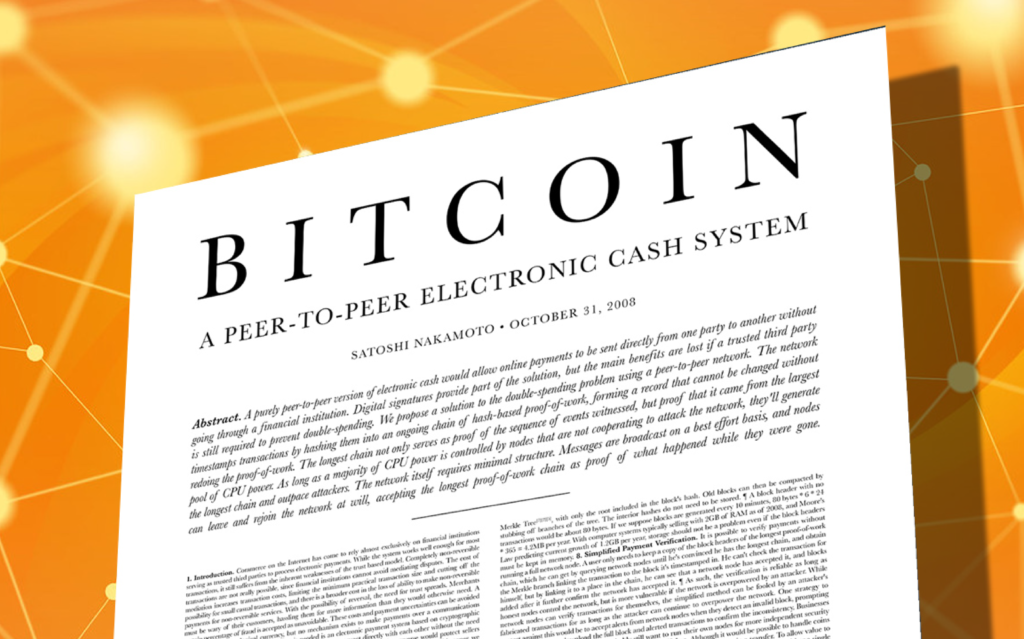

The cryptocurrency community was shaken when Coinbase, a prominent exchange, faced a major upheaval. Brian Armstrong, the CEO of Coinbase, made significant share sales amounting to $1.8 million shortly before news broke about a lawsuit filed by the U.S. Securities and Exchange Commission (SEC) against the company. In this comprehensive article, we will delve into the intricate details of Armstrong’s share sales, the allegations made by the SEC, and the potential ramifications for Coinbase and the broader cryptocurrency landscape.

Brian Armstrong’s Share Sales and the Unfolding SEC Lawsuit

Coinbase CEO Brian Armstrong executed a series of carefully planned transactions on June 5, selling approximately 29,730 company shares. These sales, totaling $1.8 million, occurred just before the SEC lawsuit became public knowledge, causing a drastic drop of more than 15% in Coinbase shares on June 6. Naturally, these developments raised eyebrows within the cryptocurrency community, leading to questions regarding Armstrong’s foreknowledge of the impending legal action.

The SEC Allegations and Their Significance

The SEC lawsuit alleges that Coinbase, under Armstrong’s leadership, operated as an unregistered broker, exchange, and clearing agency, breaching regulatory obligations. Furthermore, the regulatory body asserts that Coinbase’s staking program qualifies as an unregistered securities offering. Coinbase, in response, vehemently maintains its commitment to defending its position in court, signaling a forthcoming legal battle between the company and the SEC.

Pre-Planned Sales as a Compliance Measure

Amidst the speculations surrounding Armstrong’s share sales, it is crucial to consider the regulatory compliance aspect. Fox Business journalist Eleanor Terrett dismissed any allegations of impropriety, asserting that the sales were meticulously planned well in advance, as early as August 2022. These sales were executed in accordance with the SEC’s Rule 10b5-1, which allows company insiders to establish predetermined plans for selling stock. Notably, such plans encompass various critical details, including predetermined prices, quantities, and dates. It is essential to underscore that insiders must certify their unawareness of any nonpublic information. Terrett further emphasized that scheduling sales to coincide with specific events, such as the beginning of a fiscal quarter, is a regular occurrence and not indicative of any wrongdoing.

Analyzing Armstrong’s Past Sales and Their Coincidental Timing

The recent share sales by Brian Armstrong bear a striking resemblance to his previous activities. In March, he sold 89,196 Coinbase shares, amounting to $5.8 million. Notably, nearly half of these sales occurred just a day before the SEC issued a warning to the exchange. In April, Armstrong proceeded to sell an additional $1.8 million worth of company stocks. It is worth noting that this trend initiated in November 2022, when Armstrong pledged to sell 2% of his stake in Coinbase. These sales aimed to facilitate funding for scientific research and development through two distinct startups, namely NewLimit and Research Hub.

The recent share sales by Coinbase CEO Brian Armstrong, preceding the SEC lawsuit, have undoubtedly captivated the attention of the cryptocurrency community. However, it is essential to emphasize that these sales were meticulously planned and in full compliance with SEC regulations. The allegations leveled against Coinbase by the SEC, pertaining to its unregistered broker status and the classification of its staking program as an unregistered securities offering, will be subjected to legal proceedings. As this situation unfolds, market observers will remain vigilant, closely monitoring Coinbase’s response, and assessing the potential impact on the broader cryptocurrency landscape.

CryptOyster

Join Pearl, a fintech expert mollusk, exploring cryptocurrencies and offering market insights via OysterTrade Signals and Seabed Consultancy. Connect to explore altcoins, unravel crypto mysteries, and challenge finance norms. Dive into “Venturing Beyond Shells: Unveiling the Cryptoverse’s Enigmatic Gem” today.