Could Bitcoin be the Monetary Choice for the Future of Artificial Intelligence? Speculations by Arthur Hayes’

Arthur Hayes, co-founder and ex-CEO of BitMEX, has put forward an interesting proposition: Bitcoin may be the currency of choice for the swiftly progressing world of artificial intelligence.

Hayes, in his recent blog post named “Massa,” envisioned a time when the AI and robotics realm would take over mundane human tasks, freeing up individuals to pursue their passions. This, he suggested, could spark a new wave of artistic and cultural blossoming.

Anticipating AI’s relationship with Bitcoin. Hayes addressed the complex question surrounding the ability of AI to exceed human capabilities. He remarked,

“The inception of the first computers during WW2 sparked ongoing debates among scientists and philosophers about the evolution of cognitive machines and their influence on human existence.”

He perceives the latest developments in computational capabilities as evidence that we are at the precipice of a pivotal transformation, with AI poised to proliferate and reshape the human trajectory.

To illustrate AI’s swift uptake, Hayes highlighted the fact that ChatGPT gained 100 million monthly users within a mere two months, marking it as the “most rapidly embraced technology in human history.” This demonstrates how rapidly societal norms can shift with AI’s integration into daily life.

Considering the impact of AI on the crypto sphere, Hayes suggested viewing AI’s rising dominance as a double-edged sword from a business perspective. Its potential to influence the future of humanity and the value that it brings is appealing to him. However, he remains cautious of the upfront investment required for this novel tech, which he deems is often inflated.

Prepping for the ‘AI Rush’ As Hayes braces for the forthcoming ‘AI rush,’ he intends to use his extensive knowledge of the crypto sector to pinpoint where it converges with the unfolding AI trends. His objective is to delve into this interaction over a sequence of three essays. The first one, “Massa,” proposes Bitcoin as the likely currency for AIs.

In Hayes’s vision, sophisticated systems, like an AI capable of generating poetry, would require a secure, blockchain-based digital payment system like Bitcoin to conduct transactions. He attributes this to Bitcoin’s successful preservation of its energy-buying capacity over time.

Feeding the AI with Bitcoin? In a segment named “AI’s gotta eat,” Hayes delves into AI’s basic needs and its “sources of nutrition.” He drew parallels between AI and Bitcoin, implying that Bitcoin could be the optimal “currency” for AI operations.

Hayes noted that AI needs two crucial ingredients to exist and flourish: data for learning and formidable computational power.

This data needs hosting, which necessitates computers that consume electricity. Furthermore, AI requires a powerful computer network to process and learn from this data, which also requires electrical power. Hayes distilled AI’s nutritional sources down to semiconductors and electricity, acknowledging NVIDIA’s escalating success due to the crucial role its GPU chips play in AI advancement.

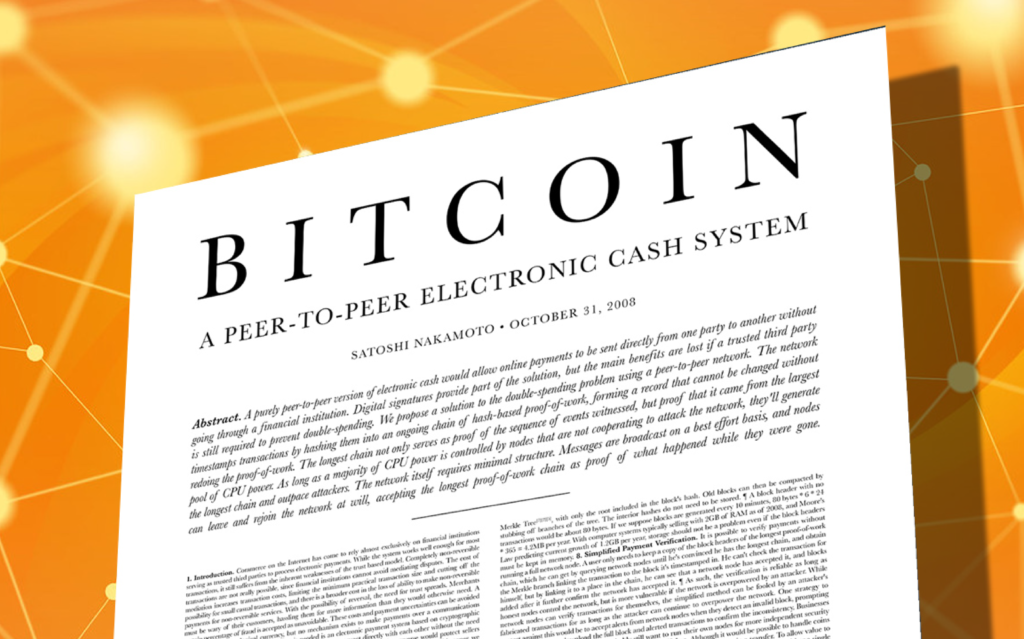

Hayes drew an intriguing correlation between AI, Bitcoin, and electricity. He compared the viability of an AI, and hence, its whole existence, to its capacity to produce more than its energy consumption. In this context, AI is akin to humans, who must generate enough value to afford their sustenance and energy. However, the ‘currency’ that an AI will accept for its output must retain its purchasing power in kilowatt-hours. Hayes argued that Bitcoin, being energy money, is the perfect candidate.

He then dissected the origins and values of gold, fiat, and Bitcoin, assessing each based on scarcity, digital censorship resistance, and energy buying power. He concluded that Bitcoin is the sensible currency choice for any AI, being entirely digital, censorship-proof, verifiably scarce, and inherently linked to electricity costs.

Hayes posited that if AI systems adopt Bitcoin, it could trigger a considerable surge in value. This is especially true if the cryptocurrency starts to be utilized by AI, resulting in a potential convergence of two distinct frenzies: the eagerness to evade inflation within the fiat financial system and the desire to own a slice of the upcoming stage of human and computer evolution. Hayes conjectures that this could motivate investors to overinvest in growth, pushing the Bitcoin network’s value to climb sharply.

Anticipating what lies ahead. While Hayes’s contemplation is more hypothetical than an assured forecast, he stressed that the biggest profits can be made when the market price transitions from “impossible” to “might just be possible.” This implies that the notion of AI adopting Bitcoin and the ensuing surge in its value is something to consider.

While Hayes concedes that he cannot forecast the exact future of AI or human civilization, his conjectures and hypotheses provide a lens into potential future landscapes.

His exploration of the symbiotic relationship between AI and Bitcoin invites us to ponder the synergistic potential of these two ground-breaking technologies and their potential evolution.