BitGo’s Striking Surge in the Crypto Custody Market

Cryptocurrencies are reshaping the world’s economic structures, and safekeeping these assets has become crucial. Amidst this backdrop, BitGo emerges as a frontrunner, showcasing an ability to adeptly pivot and grow.

A Brief History: BitGo’s Evolution

The capricious nature of the crypto market demands resilience and adaptability, attributes that BitGo possesses in abundance.

2021 Acquisition Deal Fall-through

Back in 2021, the crypto community buzzed with the news of Galaxy Digital Holdings’ prospective acquisition of BitGo for a whopping $1.2 billion. However, destiny had other plans, as this deal unraveled. But every cloud has a silver lining.

A $1.75B Valuation in 2023

Leaping to 2023, BitGo’s resilience is evident. They’ve now soared to a valuation of $1.75 billion, propelled by a fresh influx of $100 million. The journey from a missed acquisition to this monumental valuation reveals BitGo’s indomitable spirit.

BitGo’s Safety Measures in Crypto Custody

In the volatile realm of cryptocurrencies, asset security stands paramount.

Physical Vaults and Private Keys

BitGo’s reputation as a fortress in the crypto custody space isn’t unwarranted. They’ve mastered the art of safeguarding assets, often utilizing physical vaults to securely store private keys, offering a potent defense against online malefactors.

Partnerships with Major Crypto Entities

BitGo’s collaborations read like a ‘Who’s Who’ of the crypto domain. From guarding assets for the creditors of the defunct FTX to alliances with giants like Pantera Capital and Swan Bitcoin, BitGo’s influence is extensive.

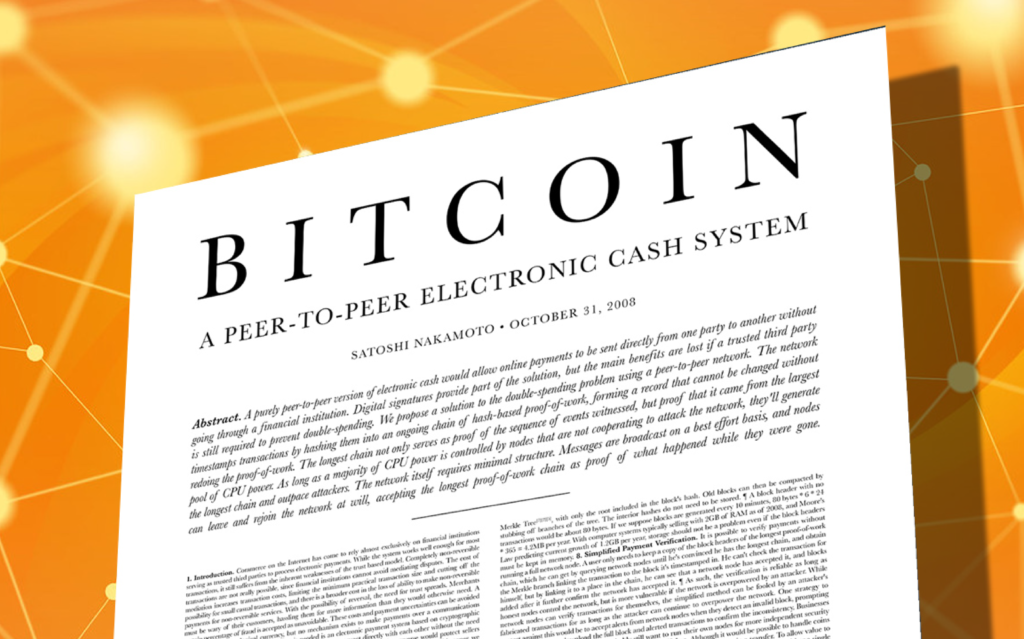

The Regulatory Edge of BitGo

In the cryptoverse, regulations are in flux, and being ahead here is a game-changer.

Classifying Cryptocurrencies as Securities

The crypto world grapples with the contentious issue of cryptocurrency classification. Amidst this maelstrom, BitGo stands tall, bolstered by its commitment to regulatory adherence.

CEO Mike Belshe on Regulatory Safety

Conversations about crypto are incomplete without touching upon regulations. Mike Belshe, BitGo’s visionary CEO, encapsulated this sentiment in his chat with Bloomberg, underlining the industry’s collective regulatory concerns.

The Significance of the Funding Round

Financial backings are more than just funds—they’re endorsements of a company’s future.

New Investors Enter the Frame

BitGo’s recent funding salvo wasn’t business as usual. Entirely fueled by new investors from both the US and Asia, this move indicates BitGo’s widening appeal, even beyond the crypto circles.

Undisclosed Names and Strategic Acquisitions

While BitGo plays its cards close to its chest regarding the identities of these investors, its strategic intent is clear. The fund infusion will partly fuel acquisitions, with a couple already lined up.

BitGo vs. Prime Trust: A Comparison

The crypto custody space has its luminaries and its cautionary tales.

Prime Trust’s Bankruptcy

Once lauded in the crypto custody domain, Prime Trust now grapples with Chapter 11 bankruptcy. Their inability to process customer withdrawals drew curtains on their saga, and simultaneously, BitGo’s planned acquisition.

The Role of ‘Trust’ in Digital Assets

The tales of BitGo and Prime Trust offer a study in contrasts. In a domain like cryptocurrency, trust isn’t merely a concept—it’s the bedrock. And as Prime Trust’s unraveling suggests, even a minor breach can have cascading effects.