Mastercard Teams Up with Blockchain Leaders for Central Bank Digital Currency Evolution

In a significant move to harness the potential of Central Bank Digital Currencies (CBDCs), global payment leader Mastercard revealed its collaboration with blockchain frontrunners Ripple, Consensys, and several others on Aug. 17. Unveiling its CBDC Partner Program, the company welcomed a range of other prominent partners, notably Fluency, Fireblock, Consult Hyperion, and Idemia, amplifying its vision of revolutionizing the payment landscape.

Pioneering the Future of CBDCs with Industry Experts

A notable trait shared by the ensemble of partners is their extensive experience and involvement in the CBDC and payment infrastructure ecosystem. This collaboration, as emphasized by Mastercard, seeks to bridge the expertise of pivotal entities, thereby ushering in innovative breakthroughs in the CBDC sphere.

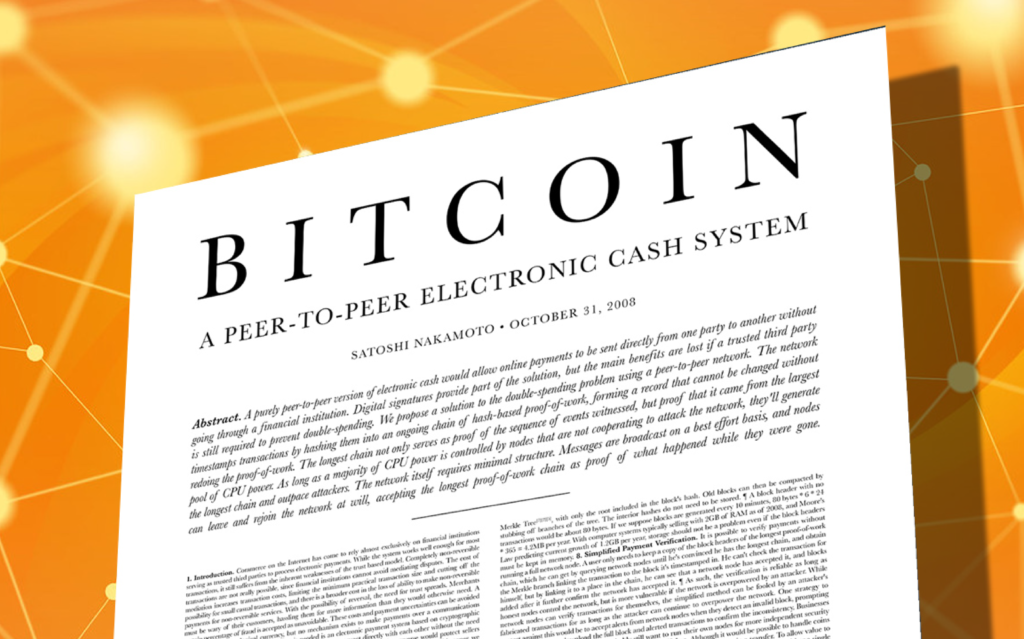

Though Mastercard’s detailed roadmap remains under wraps, its aspiration to integrate insights and feedback on CBDC development from these experts is evident. Tracing back to 2020, Mastercard’s proclivity for digital fiat currencies surfaced when they pioneered a sandbox platform, enabling central banks to fine-tune their CBDC frameworks. Furthermore, their commitment was showcased when they rolled out prepaid cards complementing the Bahamian CBDC.

With this ambitious initiative, Mastercard aims to align its objectives with other CBDC trailblazers, striving to elucidate the advantages, challenges, and safe deployment of digital currencies.

Mastercard’s Vision: Seamless and Accessible Digital Assets

Raj Dhamodharan, at the helm of Mastercard’s digital assets and partnerships, accentuated the company’s pledge to ensure digital assets resonate with the simplicity of traditional monetary forms. He highlighted the crucial role of interoperability in achieving this vision.

Leaders from the partner firms echoed similar sentiments, addressing an array of pivotal topics. From prioritizing user privacy to comprehending diverse CBDC requirements across nations, the discourse was enriched with insights.

While CBDCs are brimming with potential, Mastercard acknowledged the hurdles stymying their universal adoption. Yet, there’s unwavering optimism that the collaborative endeavors under the CBDC Partner Program will empower central banks to craft digital currencies that adeptly overcome these challenges.

Concluding with Dhamodharan’s words, “Harnessing the collective prowess, unparalleled expertise, and diverse capabilities of our partners, we’re poised to fuel innovation across the central banking landscape and the CBDC value journey as we navigate this evolving realm.”