Bitcoin’s Remarkable Surge: $4,000 Gained in Just 4 Hours, Touching $35,000 Amid BlackRock Seeding Speculation

In the volatile world of cryptocurrencies, Bitcoin (BTC) has once again demonstrated its remarkable resilience, embarking on a substantial price rally over the past week. As investors and enthusiasts closely monitor its every move, the cryptocurrency’s value has surged, gaining an impressive $4,000 in just four hours and reaching the $35,000 milestone. This surge not only reflects Bitcoin’s intrinsic strength but also sheds light on the various market factors and potential developments shaping its trajectory.

A Market in Motion

Bitcoin’s recent performance is nothing short of astounding. Over a 24-hour period, its value surged by 10.38%, and within the past seven days, it witnessed an impressive 20.42% increase. At the time of writing, Bitcoin is valued at $33,916, a testament to its enduring market appeal.

For several days leading up to this surge, Bitcoin maintained relative stability, hovering around the $31,000 mark. However, on October 23rd, a significant bullish movement took hold, propelling the cryptocurrency’s price from approximately $31,000 to just shy of $35,000. This surge was accompanied by a substantial spike in trading volume, signaling robust buying pressure within the market.

While this meteoric rise captured the attention of investors and analysts alike, a subsequent minor correction occurred on the morning of October 24th. Bitcoin’s price retraced to approximately $33,987, as indicated by the last recorded candlestick. This correction is considered a natural response following a significant peak and underscores the dynamic nature of cryptocurrency markets.

The Role of Market Developments

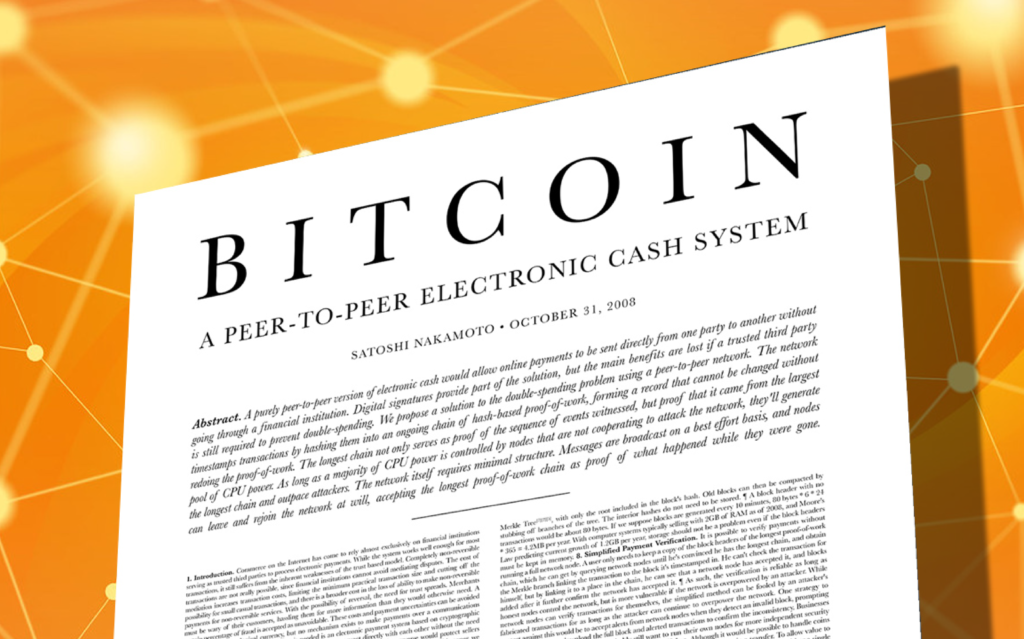

Market dynamics are often shaped by a combination of factors, and Bitcoin is no exception. Recent reports have hinted at potential developments that could further influence the digital asset’s performance. Bloomberg analyst Eric Balchunas reported that global asset manager BlackRock is contemplating seeding its iShares spot Bitcoin Exchange-Traded Fund (ETF). While no official confirmation or detailed plans have been disclosed by BlackRock, the mere consideration of such a move has the potential to significantly impact the market.

BlackRock’s potential involvement in Bitcoin ETF seeding holds significant implications. It signals the increasing interest of institutional investors in the cryptocurrency landscape, highlighting the anticipation of their entry. Furthermore, the past week has seen a remarkable 340% increase in inflows into existing digital asset funds.

The Multifaceted Nature of Bitcoin’s Price

While developments like BlackRock’s potential involvement in the Bitcoin ETF market undoubtedly contribute to the broader market context, Bitcoin’s price dynamics remain influenced by a multitude of factors. These factors include investor sentiment, regulatory changes, technological advancements, and macroeconomic trends. The cryptocurrency’s value is a reflection of the intricate interplay of these variables, and as such, it is subject to both sudden spikes and corrections.

In conclusion, Bitcoin’s recent price surge, gaining $4,000 in just four hours and touching $35,000, underscores its enduring appeal in the volatile cryptocurrency market. The potential involvement of institutions like BlackRock and the surge in digital asset fund inflows signify a growing mainstream interest in cryptocurrencies. However, it is essential to remember that the cryptocurrency market remains highly dynamic and influenced by numerous factors.