SEC Won’t Appeal Loss in Grayscale Case, Boosting the Odds GBTC Can Become a Bitcoin ETF

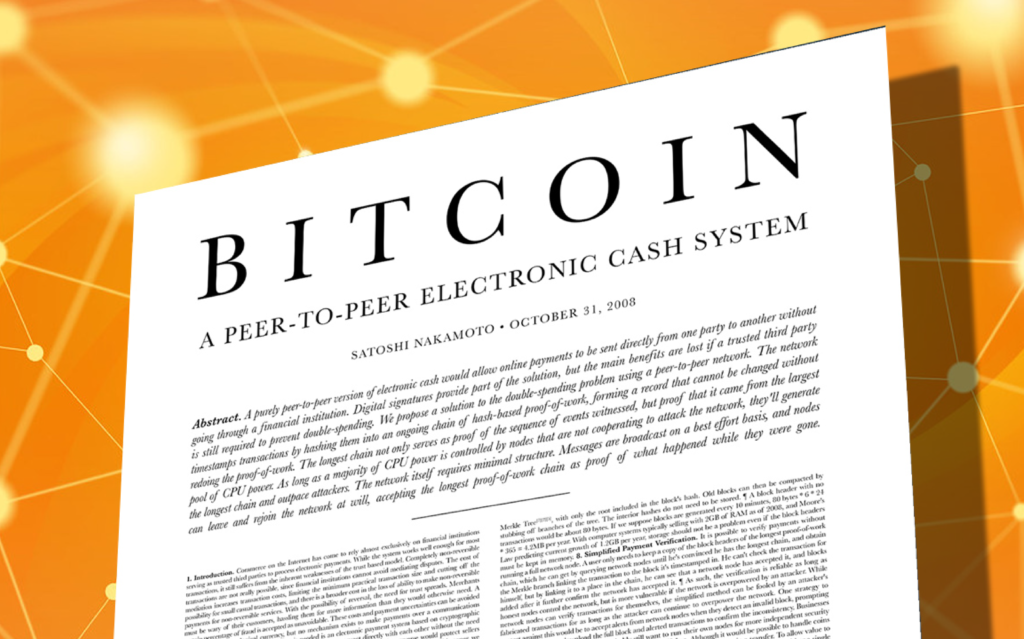

The cryptocurrency world is buzzing with excitement as the Securities and Exchange Commission (SEC) announces its decision not to appeal a recent court ruling. In August, the D.C. Circuit Court of Appeals handed down a scathing reversal of the SEC’s decision to deny Grayscale Investment’s application to convert the Grayscale Bitcoin Trust (GBTC) into an Exchange-Traded Fund (ETF). This ruling marked a turning point in the journey toward establishing the first Bitcoin ETF in the United States.

A Victory for GBTC and Bitcoin

As the news of the SEC’s non-appeal spread, Bitcoin’s price surged, shooting above $27,000. Investors and crypto enthusiasts were quick to recognize the significance of this development. The decision not to challenge the court’s ruling could potentially pave the way for GBTC to evolve into the first Bitcoin ETF in the U.S.

The Court’s Reversal

The D.C. Circuit Court of Appeals did not mince words in its judgment. It deemed the SEC’s denial of Grayscale’s application arbitrary and capricious, stating that federal agencies are obligated to treat similar cases alike. This judgment underscored the importance of fair and consistent regulatory decisions in the cryptocurrency space.

SEC’s Next Steps

While the SEC has opted not to appeal this particular decision, the path forward remains somewhat unclear. The agency still retains the authority to deny Grayscale’s application on grounds other than those rejected by the courts. Grayscale, in turn, may choose to challenge any such denial in court once again.

GBTC’s Journey

Grayscale initiated the process to convert its closed-end fund into an ETF back in October 2021. GBTC stands as the world’s largest cryptocurrency fund but has faced challenges, notably trading at a discount to its Bitcoin holdings since February 2021. Although this discount once reached nearly 50%, it has since decreased to around 17%.

Grayscale firmly believes that converting GBTC to an ETF would eliminate this discount, effectively closing the gap between the fund’s price and the underlying Bitcoin value. ETFs offer a creation-redemption model, allowing for the creation of new ETF shares to meet demand or the redemption of shares to reduce supply.

Competition in the ETF Space

Grayscale is not alone in its pursuit of a Bitcoin ETF. Several other entities, including financial giants like BlackRock and Fidelity, have filed for Bitcoin spot ETFs and are awaiting approval from the SEC. The emergence of such ETFs could mark a significant milestone in the broader acceptance and adoption of cryptocurrencies.

In conclusion, the SEC’s decision not to appeal the court’s ruling on Grayscale’s GBTC conversion application has injected new hope into the cryptocurrency market. While the path ahead remains uncertain, this development signals the possibility of a Bitcoin ETF in the United States. As the crypto industry continues to evolve, investors and enthusiasts eagerly await further developments.